A large turnout of oil and gas industry operators was recorded in Lagos on Wednesday as stakeholders converged on Eko Hotels and Suites for the Nigerian Upstream Petroleum Regulatory Commission’s (NUPRC) pre-bid conference, ahead of the licensing round for 50 oil fields.

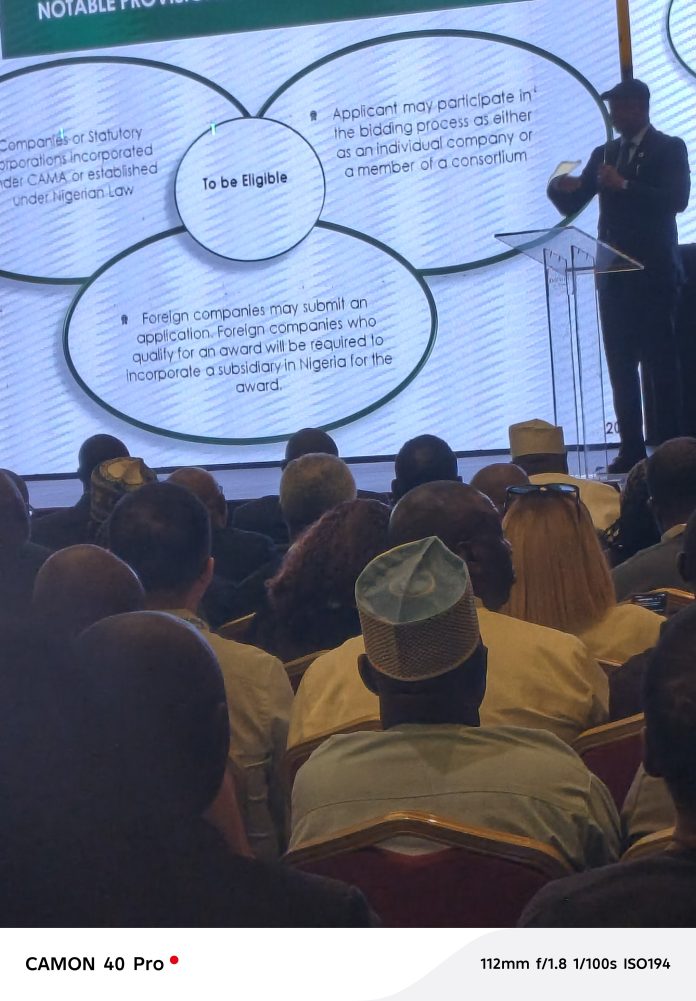

The conference forms a key milestone in the ongoing bid process, which commenced on December 1, 2025, and is designed to brief prospective bidders on regulatory requirements, eligibility conditions, and commercial expectations under the current licensing framework.

Speaking at the event, NUPRC officials emphasised that the entire process is being conducted strictly in line with the Constitution of the Federal Republic of Nigeria and all applicable laws governing upstream petroleum operations.

According to the commission, any bidder found to have made false declarations or engaged in any conduct capable of undermining integrity, transparency, or responsibility will be disqualified outright. Similarly, any breach of the terms and conditions of the competition agreement executed during the bidding process will attract automatic disqualification.

“All provisions relating to disqualification are clearly stipulated in the Bid Eligibility Resolution, and the commission will strictly enforce them as provided under the relevant eligibility laws,” the regulator stated.

One of the critical requirements highlighted during the conference is the submission of a Bid Guarantee. NUPRC explained that after the pre-qualification stage, bidders who scale through are required to submit a formal bid accompanied by a bid guarantee.

The bid guarantee must amount to five percent (5%) of the proposed signature bonus. In practical terms, whatever figure a bidder proposes as its signature bonus, the corresponding bid guarantee must reflect exactly five percent of that amount.

ALSO READ:

- Atlas Core Energy, Oyo State Pacesetter Transport Service sign 20-year landmark CNG deal

- Seplat Energy Appoints Tony Elumelu as Non-Executive Director

- ANOH Gas Project Achieves First Gas

- Falcon Corporation Celebrates Prof. Joseph Chukwurah Ezigbo on His Retirement After 31 Years of Service

- Ekpo Hails Jennifer Adighije’s Reforms at NDPHC

The guarantee must also have a validity period of one hundred and twenty (120) days, calculated from the date of the Commercial Bid Conference, at which the winning bidder will be announced. The commission noted that where the licensing process extends beyond the initial 120 days—such as to 150 days—bidders will be required to extend the validity of their bid guarantees accordingly, ensuring continuous coverage until the licence is formally awarded.

NUPRC further clarified that bid guarantees must be issued strictly by licensed commercial banks. Guarantees from non-bank or short-term financial institutions will not be accepted. The issuing banks must also be recognised and appropriately rated under Nigerian banking regulations.

Any bid submitted without a valid bank-issued guarantee, the commission warned, will be rejected. Even where such a bid is physically submitted, it will be set aside during evaluation, deemed non-responsive, and excluded from consideration.

At the Commercial Bid Conference, the winning bidder will be determined through a transparent evaluation process and formally announced. Thereafter, the successful bidder will be issued an Offer Letter by the commission.

The Offer Letter will outline specific post-award conditions that must be fulfilled within fifteen (15) days of issuance. These conditions include the submission of a valid Performance Guarantee, a firm commitment to regular payment of the agreed revenue for the first five years, and payment of the full signature bonus as stated in the bid within ninety (90) days.

NUPRC cautioned that failure to comply with any of these conditions, either wholly or partially, will lead to withdrawal of the offer. In such circumstances, the commission reserves the right to retender the licence or extend the offer to another qualified bidder, subject to the same terms and conditions.

The licensing round is expected to attract significant investment interest as Nigeria seeks to boost upstream development, optimise asset utilisation, and enhance government revenues under the Petroleum Industry Act framework